For Immediate Release:

October 2, 2015

County tax program completes 2nd successful year

Nearly 71,000 properties receive reduced 2015 tax bill

FREEHOLD, NJ – Monmouth County’s new property assessment program has completed its second year of implementation and continues to work toward being the first county in the State to decrease the overall cost of the property assessment function by stabilizing the municipal ratable base and reducing the likelihood of costly tax appeals.

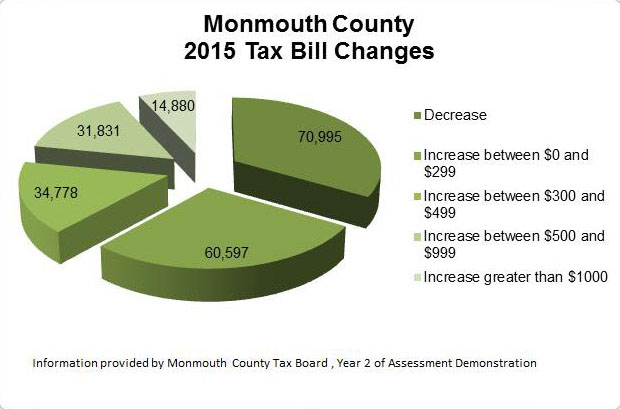

For taxpayers, the tangible results of the Real Property Assessment Demonstration Program (ADP) are represented by their tax bill. In 2015, 33 percent, or 70,995 properties, had a decrease in their tax bill; 7 percent, or 14,880 properties had a tax increase of more than $1,000.

“The State-approved ADP program has a 5-year implementation calendar that provides the framework to migrate property assessment in all 53 Monmouth County towns to an environment that will better reflect current market valuation,” said Matthew S. Clark, Administrator of the Monmouth County Tax Board.

2014 was the first full year of the ADP and the Fall of 2015 marks the end of Year 2, in which 39 towns were migrated for review under the new system.

The ADP is being conducted as a pilot program of the Monmouth County Tax Board and is advancing the County’s tax process by having local tax assessors complete the valuation portion of the assessment function that was previously performed by an outside revaluation firm.

In the old model, where revaluations occurred roughly every 10 years, a contracted appraisal firm would internally inspect and value every property and then defend the value if appealed by the taxpayer. The ADP model assigns the local Assessor with the responsibility of valuing each property and defending the value if appealed.

Under the ADP, taxpayers will see their assessment revised to market value every year and their property will be inspected once every five years (1/5th of the town, each year). Internal inspections every five years provide the Assessor with more timely details of each parcel so that the immediate and long-term accuracy of the individual assessments can be improved.

“By employing an annual reassessment system, supported by a 5-year inspection program, and having the local Assessor value and defend all assessments, the municipal Assessor will save the Monmouth County taxpayers roughly $6.9 million every 10 years,” said Clark. “This component of the ADP is intended to permanently eliminate the need for future revaluations and the dramatic tax bill shifts that often accompanied the old ‘revaluation every 10 years’ model.”

In the first two years of the program, assessments in 39 towns were converted from the old model which employed “fractional assessments” to the new “current market value” model.

A fundamental component of the ADP is to do away with assessments that only represent a fraction of a property’s current market value.

“Under the Fractional Assessment system, taxpayers are generally unaware of the relationship between the ‘assessed value,’ the ‘ratio’ and the ‘implied market value.’ If these relationships are not understood, it is difficult for taxpayers to determine if they are over-assessed,” Clark said.

Under the Fractional Assessment system, while the assessment shown on the annual Notification of Assessment Postcard may be the same from one year to the next, in truth, the taxpayer’s “implied market value” changes annually.

For example, if a property was assessed at a value of $200,000 and the town’s “Assessment-Ratio” was at 50 percent, “implied market value” was $400,000.

The ADP seeks to permanently address this systemic problem by annually maintaining assessments at current market value, meaning taxpayers no longer have to perform a “conversion” to understand if they are over-assessed.

One of the other changes of the ADP has been the shifting of dates on the tax calendar. The Notification of Assessment Postcards are now sent to taxpayers in November, prior to the start of the tax year. The assessment postcards were previously sent in February.

Also, property owners must now file county assessment appeals by January 15. The entire process of assessment review and decision-making is now completed by April 30. The old date for filing appeals with the County Tax Board was April 1.

“Shifting the calendar helps our municipalities tremendously,” said James Stuart, President of the Monmouth County Tax Board. “In the old calendar the municipal budgetary process occurred before the annual appeal process which led to municipalities having an annual tax rate that did not collect enough revenue to pay the current year’s bills. Towns would have to either utilize fund balances or perform emergency bonding with interest.”

By changing the postcard and appeal filing dates, the ADP conducts the entire appeal process prior to a municipality finalizing its budget. For the first time municipalities can avoid the “anticipated but uncollected” revenue associated with county tax appeals. This change stabilizes municipal budgets and reduces costs to taxpayers.

This new process will maintain annual stability of the municipal ratable base, reduce the likelihood of costly tax appeals, and decrease the overall cost of the property assessment function.

In the old model of “revaluation every 10 years” local Assessors were, for the most part, prohibited from changing individual assessments year to year. Over time, with neighborhoods appreciating and depreciating at different rates, the Assessor’s inability to annually change assessments caused a lack of uniformity in assessments.

This practice resulted in an unfair distribution of the annual tax levy and created an environment which was ripe for assessment appeals. When a property owner appeals an assessment, he or she must directly pay for the costs associated with the appeal process (filing fees, appraisal fees and attorney fees). The municipality must also mount a defense against the appeal; the taxpayer indirectly pays for a municipality’s defense.

Under the ADP, where the Assessor must annually review and revise every individual assessment both up or down to current market value, the Assessor is positioned to get the assessment correct in the first place. This reduces the need for appeals and significantly reduces the associated costs.

“If the initial assessments are significantly more accurate, then a considerable portion of the systemic costs associated with assessment appeals should be saved,” said Clark. “This is all for the benefit of the taxpayer.”

In 2016, seven additional towns will be migrated into the ADP; the final seven towns will be incorporated in 2017. In 2018 all 53 Monmouth County towns will be performing annual reassessments.

“There are many components to this program, but, by employing technology and advanced appraisal techniques, we will generate more accurate individual assessments each year,” said Clark. “More accurate assessments will lead to greater adherence to the Uniformity Clause of New Jersey’s Constitution which, in essence, states that everyone should pay their fair-share of the current year’s tax levy.”

In New Jersey, fair-share is based on a property’s market value as it relates to the overall value of a town. In its simplest terms, if property was worth 1% of the value of a town then it should pay 1% of the annual tax levy.

The Monmouth County Assessment Demonstration Program was recognized in 2014 by the Harvard Kennedy School’s Ash Center for Democratic Governance and Innovation for the County's pioneering work to increase the efficiency of its property tax administration procedures. The Harvard Kennedy School’s Ash Center annually recognizes and promotes excellence and creativity in the public sector.

For more information about the Assessment Demonstration Program, visit the Tax Board section of the County website at www.VisitMonmouth.com or contact your local Assessor.

# # #